originally posted on technical420.com

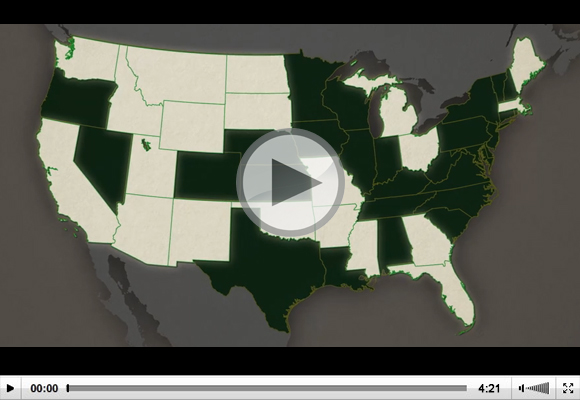

The cannabis industry continues to be one of the greatest beneficiaries of the upcoming election as several states are set to vote on legal cannabis initiatives.

The cannabis industry is currently experiencing unprecedented growth and the industry is barely in the first inning of what we expect to be a multi-decade growth cycle.

An Incredible Rally

Cannabis stocks offer both short and long term investment opportunities and the recent rally has created an incredible opportunity for investors to capitalize on short term price swings.

Although companies levered to the cannabis industry all seem like attractive investments, we recommend that you be selective with those you plan to invest in.

In late August, we highlighted three publicly traded cannabis stocks we like in this article. The stocks we recommended saw gains of 50%, 143%, and 159% in less than two months. In the article, we recommended:

- GW Pharmaceuticals (GWPH): Up 50.8%

- Kush Bottles (KSHB): Up 143%

- Aurora Cannabis (ACB: TSX-V) (ACBFF): Up 138% and 159%, respectively.

Capitalize On Short-Term Opportunities

We have been monitoring the cannabis sector very closely and Technical420 members continue to benefit from our analysis and insight. You can join this elite network by clicking here. Please reach out to support@technical420.com if you have any questions.

The cannabis sector has seen some incredible moves over the last month. One stock we recommended, OWC Pharmaceutical Research Corp. (OWCP) is up more than 3800% in the last month. Although we are favorable the company’s recent announcements, we are cautious at current levels as the rally is a little overdone in our mind.

On our Radar Screen

We currently have more than 20 cannabis stocks on our radar screen and these companies represent short term opportunities, long term investments as well as stocks that fall under both categories.

A company that recently came back on our radar screen is mCig Inc. (MCIG). The company’s stock went on a remarkable run over the two months and the shares have fallen more than 35% from its highs last week.

Today, mCig CEO Paul Rosenberg issued a corporate update and announced that three of its four divisions are profitable. He also said that the company has become much more geographically diverse following the addition of new clients, new products roll outs, and continued market penetration through existing product lines and expanded distribution agreements.

Down From its Highs

MCIG has rallied more than 150% in the last month and we are favorable on this morning’s update as the company reported a significantly improved financial position, new strategic partnerships, as well as a product update.

mCig is comprised of several business units that have made significant progress over the last year and we will continue to monitor how MCIG trades as we monitor the stock for a buy opportunity.

Click below to get a full break down on exactly which states could be voting this Fall, and which stocks stand to benefit from these new laws.