2016 could be a record year Cannabis legalization. One of the easiest safest ways to capitalize on the green rush is to invest in cannabis stocks before anyone else. Michael Berger of Technical420.com explains why Mass Roots may be one of the best investment opportunities in the cannabis industry.

Originally posted on Moneyshow.com

A record number of states have cannabis initiatives on the ballot this November and Michael Berger, Associate Editor of MoneyShow.com highlights a cannabis technology company that will benefit from these legalization measures.

Although the cannabis sector offers investors a lot of opportunity, it offers even more risk and one must be cautious before entering this market.

Over the last two years, the market has seen a significant increase in the number of publicly traded cannabis companies and as this number has increased, so has the number of cannabis stock promoters, which has made it more difficult for investors to find value.

Selectivity Is Key to Success

When it comes to investing in the cannabis industry, investors need to focus on companies that are well capitalized, led by a management team with a proven track record, have a sound financial structure, act in the best interests of shareholders, and continue to execute on business initiatives.

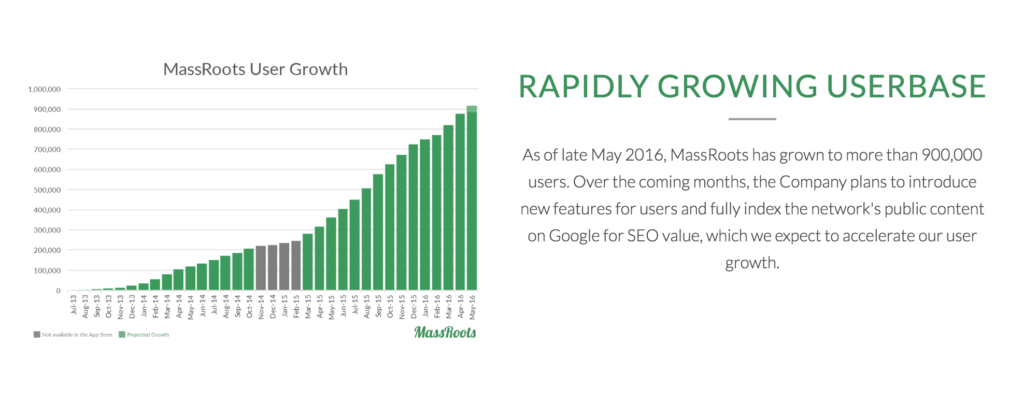

One of the companies that possesses these traits is MassRoots, Inc. (MSRT), which is comprised if one of the largest and most active communities of cannabis consumers.

The social network formed in April 2013 and is considered to be the Instagram of the cannabis industry. MassRoots started as an online community for people who smoke cannabis but it has grown into much more as management continues to execute.

Continues to Strengthen its Team

One of MassRoots’ strengths starts right from the top with CEO Isaac Dietrich who through strategic hires continues to strengthen its management team and advisory board.

Yesterday, the company announced that Steve Markowitz joined its Board of Advisors. Markowitz served as Chairman and Chief Executive Officer of MyPoints.com, Inc., leading its growth from zero to 16 million consumer members, scaling annual revenues to $64 million. Under Markowitz’s direction, MyPoints.com listed on Nasdaq in August 1999 and achieved a peak market value of $2.3 billion.

In late June, MassRoots hired Lance Galey as its Chief Technology Officer. Galey served as Chief Software Architect of Cloud Services for Autodesk and Vice President and Principal Architect at Salesforce where he led the architecture and development of numerous core infrastructure and platform services.

Shortly after hiring Lance Galey, MassRoots announced that Anthony Nystrom Mashable’s Principal for Artificial Intelligence joined its Board of Advisors. Nystrom came on board to advise and assist with technologies utilizing artificial intelligence and machine learning to expand the diversity and capabilities of its platform.

Scaling Revenues at Minimal Costs

One of the most attractive aspects of MassRoots stems from the fact that it will not incur much additional costs while its revenues continue to ramp.

CEO Dietrich stated that MassRoots is focused on ramping revenue through automation and technology rather than additional staff and overhead, which given nature of its business is the right approach.

New Features, New Revenue Streams

In late July, MassRoots launched its dispensary finder that aims to connect its community with dispensaries and products in their local area. Within a week, more than 100 dispensaries signed a one-year listing contract for its dispensary finder at a special rate of $42 a month.

Shortly after the launch of the dispensary finder application, MassRoots announced that it had added larger pins on its dispensary map, which offers dispensaries increased exposure to its community at a higher cost.

Each new feature creates a new revenue stream for MassRoots and we expect to see revenue continue to grow as companies continue to adapt to these new opportunities.

Over the next few months, MassRoots plans to release new features which will add value to the company’s bottom line. Some of the features we expect to see launched are enhanced profiles, improved sponsored posts, and product review pages.

Valuation has Improved as the Election Nears

With marijuana legalization continuing to open new markets and MSRT continuing to improve its service through new features and new developers, we expect to see shares move higher.

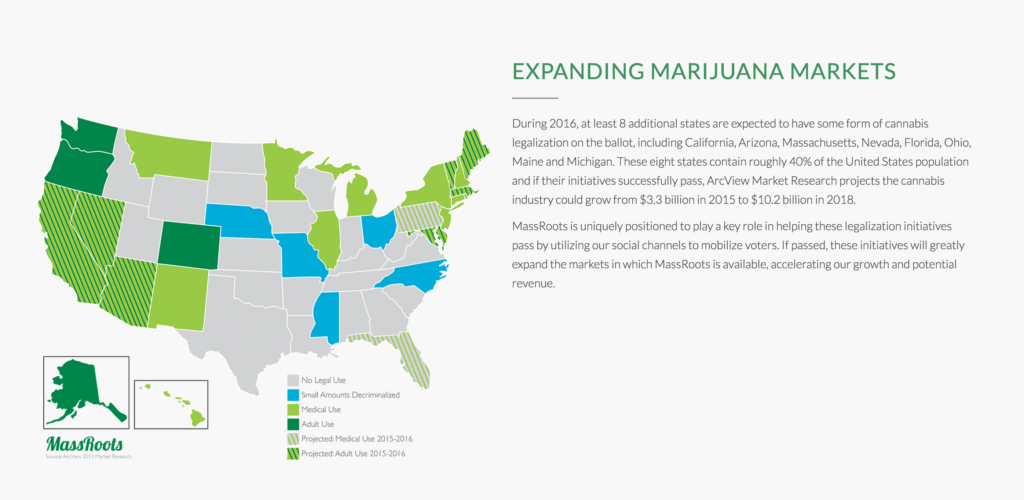

This November, a record number of states (at least nine) will have some type of cannabis initiative on the ballot. California, Arizona, Nevada, Massachusetts, and Maine will vote on recreational cannabis, while Florida, Arkansas, and North Dakota will vote on medical cannabis. These states have close to 40% of the United States population and this would significantly increase the company’s total addressable market.

We continue to see long-term value in shares of MSRT as it continues to execute on its business plan and create value for shareholders. Earlier this month, CEO Dietrich purchased 25,000 shares of MSRT at $0.50 a share and we see significant upside to the current share price.

By Michael Berger, President of Technical420.com